He uses two very simple examples of how bond returns are becoming volatile as interest rates start moving up. The logic is simple and well understood by anyone who understands bond markets: a fixed-rate bond that was issued yesterday will see its price change if interest rates move (in an unexpected manner) over the horizon over which the bond is outstanding. Here is a quote from his article:

"As a simple illustration, consider the 5-year US Treasury note issued at the end of March. A low coupon and relatively modest yield curve roll-down meant the most investors could reasonably expect at issuance was a total return of 2.7 per cent over the subsequent two-year period. If, however, five-year rates were to go up by 70 basis points, which in fact they did over the next three months, the bond was already 3.25 per cent under water (as of the June 25 close), altering the risk/return outlook."

Correct. Bonds that were issued in March under the assumption that interest rates will remain low over the next five years now look like a poor investment because the market today is looking at a scenario of higher interest rates. Without debating on whether the market is right or wrong, this is something that is standard in bond markets. News on future interest rates will cause volatility on bond prices. By reading the article one gets the impression that the current volatility is unusual and that it is the fault of the zero interest rate policy of central banks and quantitative easing. Quoting from the article:

"This dynamic was exaggerated when securities were artificially compressed by experimental central bank policy."

I can see the market is indeed getting worried about the exit strategy and that we are potentially heading for some volatile period in terms of interest rates. But what is nor correct is to argue that what we are seeing is that unusual. Any time monetary policy gets tighter (regardless of the level of interest rate), we see volatility in interest rates. And in previous episodes we have seen volatility that is possibly as high or higher than what we have witnessed so far.

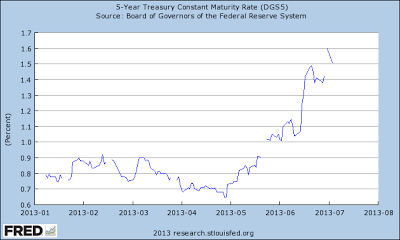

Below are the plots of the interest rate on the 5-year US Treasury note around the current episode and during the 1994 episode of monetary tightening by the Fed.

The two episodes are not directly comparable but as we can see that during the 1994 episode, 5-year rates increased from 5% to 7% in a matter of 2 to 3 months (in the current episode we have seen rates increasing by about 0.8% in the last two months). This time it is very likely that 5-year rates will continue to go up and possibly increase by more than in previous periods of monetary tightening (if we measure it in percentage points). And this might be a surprise to some who thought that growth will never return and it might not be a surprise to those who are indeed betting that interest rates will go up and are trying to make money on that bet (as Pimco has done in the past). Putting the blame on this volatility on the central bank and the current monetary policy stance is not correct. Markets trade on differences of opinion about the future. Some will be right and some will be wrong and these will generate volatility in ex-post returns. While central banks can be proactive and provide forward guidance on their policies, they cannot control everyone's expectations about future interest rates. If we want to judge central bank policies and their communications we need to wait and see if the forward guidance they provided was a good indication of what they did later.

Antonio Fatás