The 2008 crisis has resulted in significant downward revisions of potential growth for most advanced economies. As output collapsed we revised down our expectations of what is feasible in the long-term. This has resulted in estimates of potential output that are much lower than the ones we had before the crisis. There are several interpretations of these revisions, some of which can be very depressing.

One interpretation is that we just realized that demographics and technology would not be as favorable as we thought going forward. The crisis might have raised awareness that demographic trends (aging) combined with weaker productivity growth will be unable to deliver the same growth rates as before. This is bad news but if this is what is going on, then we need to accept it or find ways to reverse those trends (increasing retirement age, finding levers for faster innovation,...).

But this cannot be the main story behind the revisions of potential output given that most of the revisions are about the level of GDP, not so much about the growth rate going forward. As an illustration, I am plotting below the output gap for Italy as estimated by the IMF World Economic Outlook back in April 2009 and in its latest issue (April 2014). The output gap is the difference between actual GDP and potential GDP.

Since the crisis started not only we have changed our views about the future but we have also changed our views of the past. If you look at the blue line you can see that in 2009 we thought that the Italian economy had been growing at a rate similar to potential output for the previous 19 years (and remember that growth rates in Italy were already low during most of these years). But today we believe that Italy was producing "too much" during all those 19 years (with the exception of 1993). Every single year Italy was somehow employing too many workers or those workers where being too productive. Why that change? Because of the interpretation that some (most?) of the GDP fall during the crisis will be permanent and to make this consistent with what happened before the crisis we need to lower out estimates of potential output in those years as well. Let me me be clear, we have no theory and no direct evidence that potential output during those years was lower than what we thought before, we are simply finding a way to validate the current level of output that seems to be going nowhere. And because it GDP refuses to grow it must be permanent and structural.

The alternative (and much more depressing) interpretation is that a crisis, which is clearly global in its nature, this is not an Italian crisis, has resulted in a a very long period of low growth. This low growth has had an effect on potential output because long-term growth rates cannot be completely separated from cyclical conditions. Labor market conditions have an effect on long-term unemployment, discouraged workers and participation rates (what Blanchard and Summers called backed in 1986 hysteresis in labor markets). But even more fundamentally, investment rates, technology adoption are slowed down by cyclical conditions and these are the forces that drive potential growth rates. So the longer is the recession, the bigger the impact on potential output (I was very interested in these dynamics back in the late 90s and wrote a couple of papers with supporting empirical evidence: here and here).

From a policy point of view the two interpretation lead to completely different recommendations. Under the first interpretation we have been living in a fictitious world for the last 20 years thinking that we were more productive. Finally we understand that we are not so it is the time to adjust and live within our means. As this working paper from Bundesbank puts it

Consequently, earlier growth paths are probably no longer achievable, particularly for some European countries. Substantial macroeconomic imbalances built up... and painful adjustment processes are now underway. Attempts to explain this merely through a major shortfall in aggregate demand are far from convincing.

Under the alternative scenario we are now learning that the costs of crises are a lot larger than what we thought. We are not just talking about transitory output losses but events that leave permanent scars on the level of GDP. So it is time to react and generate enough growth not just to go back to potential but to restore the mechanisms that drive its long-term growth.

Antonio Fatás

Wednesday, September 17, 2014

Sunday, September 14, 2014

ECB: QE or QT (Quantitative Tightening)?

Charles Wyplosz at VoxEU questions the potential effectiveness of quantitative easing (QE) as recently announced by the ECB. His main concern is that the ECB version of QE is supply driven, as opposed to the one implemented by the other central banks which is demand driven.

In the case of the US Federal Reserve or the Bank of England, the central bank buys securities and those securities permanently increase the size of the bank's balance sheet. Liquidity is provided regardless of the actions of commercial banks. In contrast, the ECB so far had always relied on the demand from commercial banks for liquidity. The ECB made loans available to commercial banks, and as long as commercial banks demanded those loans, the balance sheet of the central bank also increased (with the deposits of commercial banks being the liability that appears on the other side). But this means that in many ways commercial banks are driving QE. It is their desire to hold more liquidity the one that determines the expansion (or contraction) in the size of the ECB balance sheet.

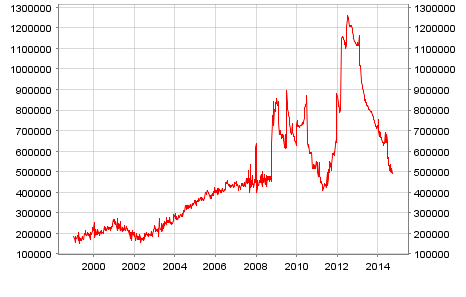

To understand these dynamics, here are some charts from the ECB web site. First the total size of the balance sheet of the ECB.

We can see several steps after 2008 that increased the size of the ECB balance sheet to about 3 trillion Euros. But we can also see that since 2013, the balance sheet has decreased by more than 1 trillion euros (and no one noticed, by the way). What was he ECB doing? Not much. This is simply the outcome of commercial banks returning the loans that they have gotten earlier from the ECB. Here is the chart with those loans ("lending related to monetary policy operations").

And remember that these loans had to be sitting somewhere else on the liability side of the ECB, they appear as deposits of commercial banks (reserves). Here are the balances of the two accounts where these funds are held (current account and deposit facility).

The pattern of the four charts is very clear: the availability of liquidity by the ECB led to a very large amount of loans being demanded by commercial banks. This increased the size of the balance sheet and the deposits of commercial banks on the ECB. This liquidity had limited effect on lending to the private sector (although it probably protected the financial sector from an even-larger crisis). But as economic conditions stabilized or improved, commercial banks saw no need to hold such large amounts of liquidity so they simply paid back the loans to the central bank. The fact that interest rates on these deposits are now negative led to an acceleration of this trend. So the actions of the central banks (such as negative interest rates on banks' deposits) are not creating an incentive for commercial banks to lend, they are simply creating an incentive for the liquidity that the ECB created to decrease substantially (reverse QE!).

In the last months the ECB has tried to be more aggressive, first with the launch of targeted long term refinancing operations (TLTRO) back in June. But the details of this plan are still unclear (does anyone remember it?) plus it relies once again on the willingness of commercial banks to lend to the private sector and finance this lending via the central bank. But we just saw commercial banks returning all the liquidity that they had previously borrowed from the ECB. Why will the ask for more?

In the last meeting, the ECB announced a change in strategy with the plan to purchase asset-backed securities. While in some sense this is the first time where the ECB will engage in supply-driven QE (no loans associated to these purchases), the wording of the plan has left many questions open about the extent to which this is a "permanent-enough" commitment to increase the ECB balance sheet and, in addition, the potential volume of these purchases could be small. Small enough that they will not be compensating the fall in the ECB balance sheet that we have witnessed in the last year.

Unfortunately, the ECB is likely to face soon the same question it has faced over the last years: what is next?

Antonio Fatás

In the case of the US Federal Reserve or the Bank of England, the central bank buys securities and those securities permanently increase the size of the bank's balance sheet. Liquidity is provided regardless of the actions of commercial banks. In contrast, the ECB so far had always relied on the demand from commercial banks for liquidity. The ECB made loans available to commercial banks, and as long as commercial banks demanded those loans, the balance sheet of the central bank also increased (with the deposits of commercial banks being the liability that appears on the other side). But this means that in many ways commercial banks are driving QE. It is their desire to hold more liquidity the one that determines the expansion (or contraction) in the size of the ECB balance sheet.

To understand these dynamics, here are some charts from the ECB web site. First the total size of the balance sheet of the ECB.

We can see several steps after 2008 that increased the size of the ECB balance sheet to about 3 trillion Euros. But we can also see that since 2013, the balance sheet has decreased by more than 1 trillion euros (and no one noticed, by the way). What was he ECB doing? Not much. This is simply the outcome of commercial banks returning the loans that they have gotten earlier from the ECB. Here is the chart with those loans ("lending related to monetary policy operations").

And remember that these loans had to be sitting somewhere else on the liability side of the ECB, they appear as deposits of commercial banks (reserves). Here are the balances of the two accounts where these funds are held (current account and deposit facility).

The pattern of the four charts is very clear: the availability of liquidity by the ECB led to a very large amount of loans being demanded by commercial banks. This increased the size of the balance sheet and the deposits of commercial banks on the ECB. This liquidity had limited effect on lending to the private sector (although it probably protected the financial sector from an even-larger crisis). But as economic conditions stabilized or improved, commercial banks saw no need to hold such large amounts of liquidity so they simply paid back the loans to the central bank. The fact that interest rates on these deposits are now negative led to an acceleration of this trend. So the actions of the central banks (such as negative interest rates on banks' deposits) are not creating an incentive for commercial banks to lend, they are simply creating an incentive for the liquidity that the ECB created to decrease substantially (reverse QE!).

In the last months the ECB has tried to be more aggressive, first with the launch of targeted long term refinancing operations (TLTRO) back in June. But the details of this plan are still unclear (does anyone remember it?) plus it relies once again on the willingness of commercial banks to lend to the private sector and finance this lending via the central bank. But we just saw commercial banks returning all the liquidity that they had previously borrowed from the ECB. Why will the ask for more?

In the last meeting, the ECB announced a change in strategy with the plan to purchase asset-backed securities. While in some sense this is the first time where the ECB will engage in supply-driven QE (no loans associated to these purchases), the wording of the plan has left many questions open about the extent to which this is a "permanent-enough" commitment to increase the ECB balance sheet and, in addition, the potential volume of these purchases could be small. Small enough that they will not be compensating the fall in the ECB balance sheet that we have witnessed in the last year.

Unfortunately, the ECB is likely to face soon the same question it has faced over the last years: what is next?

Antonio Fatás

Wednesday, September 10, 2014

The Euro crash?

As the US federal reserve might start soon raising interest rates and the ECB is about to being his quantitative easing plans, some see this divergence as a potential source of a large fall in the value of the Euro that might have already started over the last days.

Given that we have witnessed in the past similar episodes of divergence in monetary policy (or at least monetary policy moving at very different speeds), it is interesting to check what happened during those episodes.

Below is the evolution of the USD/EUR exchange rate since 1975 (click on the picture for a larger version). Of course, the Euro did not exist before 1999 but what I have done is to replace the Euro with the German Mark (converted at the Mark/Euro rate that was fixed at the time the Euro was launched). So the chart is really a combination of the German/US exchange rate before 1999 and the Euro/US exchange rate post-1999. I will refer to the Euro even in the earlier years for simplicity.

The line drifts up mostly because inflation in Europe has consistently been below that of the US (we expect the currency with the higher inflation to depreciate over time). The effect is more pronounced in the early decades because that's when inflation differentials were the largest (between Germany and the US).

In addition to the trend we see two episodes where the dollar strengthened substantially relative to the Euro and then reversed in the opposite direction at a similar speed to go back towards its trend. The first episode was in the early 80s where a combination of tight monetary policy and large budget deficits in the US put upward pressure on interest rates and started a persistent swing upwards of the US dollar. The US dollar reached a value that was clearly above any reasonable estimate of fundamentals and led to the Plaza Accord in September 1985 where finance ministers from Europe, Japan and the US agreed to intervene to keep the dollar from continuing its appreciation. The reversal that followed was also very dramatic.

The second episode takes place in the mid to late 90s and coincides with very strong growth rates in the US that also attracted the interest of investors. Monetary policy itself was not that different but growth rates were. In addition the launch of the Euro in 1999 was viewed by some as a source of uncertainty and potential bad news for the Euro economy and its currency. This time, the appreciation of the US dollar was also stopped by a coordinated intervention of the US federal reserve and the ECB in November 2000.

In these two episodes we do see a pattern of divergence in economic conditions between Europe and the US that triggers an appreciation of the US currency although not always related to monetary policy (and in both cases the appreciation led to overvaluation and large volatility). Are we supposed to expect the same thing now? It is certainly a possibility but far from from guaranteed. Why? Because if we look carefully at some of the other years we will see that there are several other episodes during which US growth was also stronger than European growth and US interest rates were raising faster and the US dollar did not appreciate, in fact it depreciated significantly.

For example, in the period 2002-2003 Europe was in the middle of a recession with growth rates that were significantly lower than those of the US. Interest rates in Europe were coming down and remained at 2% until the fall of 2005. At the same time, US interest rates were climbing from a low 1% to 5.25% by the summer of 2006. In those years, the dollar not only did not appreciate but instead it depreciated relative to the Euro. In January 2002 the exchange rate was below 0.9 USD/EUR and by 2005 the Euro had climbed to 1.30 USD/EUR.

It is also interesting to notice that since the 2008 crisis started, the USD/EUR exchange rate has remained quite "stable" (compared to most other previous years). It has fluctuated between 1.25-1.40 despite the dramatic changes that we have seen on both sides of the Atlantic. The sovereign debt crisis in Europe was forecasted to have a large effect on the value of the Euro but the currency remained stable all through the crisis.

If economic conditions continue to diverge between the US and Europe and the Euro depreciates heavily relative to the US Dollar, no one will be surprised. It will clearly look like a great textbook illustration about how interest rates and capital flows move currencies. But history tells us that there is no guarantee that this will happen, exchange rates are a lot more volatile and unpredictable than what some theories make you believe. Regardless of the final change in the exchange rate, what is very likely is that we will witness a lot more volatility in exchange rates over the coming months and years, in contrast with the stability that we have enjoyed for the last years.

Antonio Fatás

Given that we have witnessed in the past similar episodes of divergence in monetary policy (or at least monetary policy moving at very different speeds), it is interesting to check what happened during those episodes.

Below is the evolution of the USD/EUR exchange rate since 1975 (click on the picture for a larger version). Of course, the Euro did not exist before 1999 but what I have done is to replace the Euro with the German Mark (converted at the Mark/Euro rate that was fixed at the time the Euro was launched). So the chart is really a combination of the German/US exchange rate before 1999 and the Euro/US exchange rate post-1999. I will refer to the Euro even in the earlier years for simplicity.

The line drifts up mostly because inflation in Europe has consistently been below that of the US (we expect the currency with the higher inflation to depreciate over time). The effect is more pronounced in the early decades because that's when inflation differentials were the largest (between Germany and the US).

In addition to the trend we see two episodes where the dollar strengthened substantially relative to the Euro and then reversed in the opposite direction at a similar speed to go back towards its trend. The first episode was in the early 80s where a combination of tight monetary policy and large budget deficits in the US put upward pressure on interest rates and started a persistent swing upwards of the US dollar. The US dollar reached a value that was clearly above any reasonable estimate of fundamentals and led to the Plaza Accord in September 1985 where finance ministers from Europe, Japan and the US agreed to intervene to keep the dollar from continuing its appreciation. The reversal that followed was also very dramatic.

The second episode takes place in the mid to late 90s and coincides with very strong growth rates in the US that also attracted the interest of investors. Monetary policy itself was not that different but growth rates were. In addition the launch of the Euro in 1999 was viewed by some as a source of uncertainty and potential bad news for the Euro economy and its currency. This time, the appreciation of the US dollar was also stopped by a coordinated intervention of the US federal reserve and the ECB in November 2000.

In these two episodes we do see a pattern of divergence in economic conditions between Europe and the US that triggers an appreciation of the US currency although not always related to monetary policy (and in both cases the appreciation led to overvaluation and large volatility). Are we supposed to expect the same thing now? It is certainly a possibility but far from from guaranteed. Why? Because if we look carefully at some of the other years we will see that there are several other episodes during which US growth was also stronger than European growth and US interest rates were raising faster and the US dollar did not appreciate, in fact it depreciated significantly.

For example, in the period 2002-2003 Europe was in the middle of a recession with growth rates that were significantly lower than those of the US. Interest rates in Europe were coming down and remained at 2% until the fall of 2005. At the same time, US interest rates were climbing from a low 1% to 5.25% by the summer of 2006. In those years, the dollar not only did not appreciate but instead it depreciated relative to the Euro. In January 2002 the exchange rate was below 0.9 USD/EUR and by 2005 the Euro had climbed to 1.30 USD/EUR.

It is also interesting to notice that since the 2008 crisis started, the USD/EUR exchange rate has remained quite "stable" (compared to most other previous years). It has fluctuated between 1.25-1.40 despite the dramatic changes that we have seen on both sides of the Atlantic. The sovereign debt crisis in Europe was forecasted to have a large effect on the value of the Euro but the currency remained stable all through the crisis.

If economic conditions continue to diverge between the US and Europe and the Euro depreciates heavily relative to the US Dollar, no one will be surprised. It will clearly look like a great textbook illustration about how interest rates and capital flows move currencies. But history tells us that there is no guarantee that this will happen, exchange rates are a lot more volatile and unpredictable than what some theories make you believe. Regardless of the final change in the exchange rate, what is very likely is that we will witness a lot more volatility in exchange rates over the coming months and years, in contrast with the stability that we have enjoyed for the last years.

Antonio Fatás

Sunday, September 7, 2014

Whatever it takes to see helicopter Mario (Draghi)

Mario Draghi surprised markets last week with a further cut in interest rates and a QE plan to start purchases of assets to expand the ECB balance sheet. These two actions were welcome as well as the change in the content and tone of his comments that are finally make it clear the need for strong policy actions in Europe.

Unfortunately, the fear is that this is coming too late and might not be enough. While the ECB plan to buy assets could expand its balance sheet over the coming months, the reality is that this move might just take its size to where it was several months ago. It is true that purchases of certain assets could have a stronger impact than the previous rounds of bank lending, but this might not be enough.

And when it comes to interest rates, while the ECB has finally reached zero, it took so long that in the last months the Euro area has seen a dangerous move towards very low inflation. And as inflation went down, real interest rates went up. Below is a chart that compares real interest rates in the Euro area and the US (real interest rates are calculated as the central bank interest rate minus the one-year inflation over the previous year).

First thing we noticed is that since the the summer of 2012 real interest rates have increased in Europe while they have remained broadly stable in the US. In the last two years, while real interest rates have increased by more than 1% in Europe, they have gone down by about 1% in the US. And this is all the result of the difference in behavior in inflation, which is possibly the result of the differences in policies we see during 2011 with much higher interest rates in the Euro area than in the US.

If the recent ECB actions are not enough, what else is to be done? Maybe European governments start listening to Mario Draghi and we see a reversal of fiscal policy, possibly in a coordinated fashion across Euro members. In the absence of this, the ECB has very few tools left at its disposal. It could try to increase inflation expectations, hoping that this would translate into increases in wages and prices. But raising inflation expectations would require very strong communications possibly making explicit that a temporary deviation of inflation above 2% would be welcome. Or even better, an explicit increase in the inflation target of the ECB (which could be temporary, for X years).

The only other alternative is "helicopter money", which implies a permanent increase in the monetary base/supply via either permanent purchases of assets or direct transfers to the governments or households (read Simon Wren-Lewis explain the difference between QE and helicopter money or Willem Buiter discuss why helicopter money always works). There has been some recent talk among central bankers about this idea but it has always been ruled out because of legal or practical constraints, which are likely to be more binding in the case of the ECB.

The discussion around helicopter money in the US led to the expression "helicopter Ben" to refer to the former chairman of the federal reserve, Ben Bernanke. Maybe it is time to see "helicopter Mario" do whatever it takes to save the Euro area. And finding a picture to illustrate what this would look like is so much easy with Mario Draghi...

Antonio Fatás

Unfortunately, the fear is that this is coming too late and might not be enough. While the ECB plan to buy assets could expand its balance sheet over the coming months, the reality is that this move might just take its size to where it was several months ago. It is true that purchases of certain assets could have a stronger impact than the previous rounds of bank lending, but this might not be enough.

And when it comes to interest rates, while the ECB has finally reached zero, it took so long that in the last months the Euro area has seen a dangerous move towards very low inflation. And as inflation went down, real interest rates went up. Below is a chart that compares real interest rates in the Euro area and the US (real interest rates are calculated as the central bank interest rate minus the one-year inflation over the previous year).

If the recent ECB actions are not enough, what else is to be done? Maybe European governments start listening to Mario Draghi and we see a reversal of fiscal policy, possibly in a coordinated fashion across Euro members. In the absence of this, the ECB has very few tools left at its disposal. It could try to increase inflation expectations, hoping that this would translate into increases in wages and prices. But raising inflation expectations would require very strong communications possibly making explicit that a temporary deviation of inflation above 2% would be welcome. Or even better, an explicit increase in the inflation target of the ECB (which could be temporary, for X years).

The only other alternative is "helicopter money", which implies a permanent increase in the monetary base/supply via either permanent purchases of assets or direct transfers to the governments or households (read Simon Wren-Lewis explain the difference between QE and helicopter money or Willem Buiter discuss why helicopter money always works). There has been some recent talk among central bankers about this idea but it has always been ruled out because of legal or practical constraints, which are likely to be more binding in the case of the ECB.

The discussion around helicopter money in the US led to the expression "helicopter Ben" to refer to the former chairman of the federal reserve, Ben Bernanke. Maybe it is time to see "helicopter Mario" do whatever it takes to save the Euro area. And finding a picture to illustrate what this would look like is so much easy with Mario Draghi...

Antonio Fatás

Tuesday, September 2, 2014

Wage moderation: a recipe for growth?

In the economic policy debate in the Euro area it is common to hear a reference to the need for structural reforms in order to improve competitiveness, under the assumption that this is the recipe that Germany has followed so successfully over the last years. To this logic it is common to add a recommendation for wage moderation. Low wage growth seems to be a necessity in Europe given the increased competition from emerging markets. While there can be some truth to this argument, let me show some evidence that questions some of the facts and then present some additional conceptual concerns with the way wage moderation and competitiveness are normally linked.

Below is a chart that summarizes data provided by the OECD on productivity, compensation and unit labor costs. I computed the accumulated change from 2000 to 2013 (except for the US where there was no data for 2013, so the period is 2000-2012).

The blue column (real GDP per hour) represents improvements in productivity. This is the ultimate source of sustainable improvements in living standards. What we see is a significant gap between the US and Europe (more so if we consider that the US is 'missing' one year). When we look inside Europe we see a big outlier: Italy, where GDP per hour has barely changed in the last 13 years. There are some interesting differences among the other countries with Spain seeing an 18% increase over the period compared to 15% in Germany and 12-13% in France and the UK. In this first column, there is no obvious German miracle during this 13 years.

The second number is labor compensation per hour. This is measured in nominal terms (i.e. current Euros or US dollars or UK pounds) as it should be when talking about competitiveness. One expects that increased productivity gets reflected in increased compensation (in real terms) and in addition we should see the effect of inflation. Here Germany stands out as the country with the lowest wage increase (per hour). To make sense out of this number we should compare it to the increase in productivity as measured by GDP per hour. This is what the third column, the unit labor cost (ULC) does, it is simply equal to the change in labor compensation per hour minus the change in output per hour.

When looking at ULC we see that Germany has seen the lowest increase in labor costs per unit of output but not because of the highest increase in productivity but because of wage moderation relative to productivity gains. Italy and the UK are the countries with the largest increase in ULC through a combination of zero (Italy) or average (UK) productivity gains combined with significant wage growth. This is the German "miracle", the ability to convince workers to get paid less (relative to productivity) than in other countries. This is good news for German firms.

To make the "German miracle" look even stronger we can replicate the same analysis for the pre-crisis period (2000-2007).

Here we can see how Germany was even more of an outlier in terms of ULC. Once again we see wage moderation combined with good productivity growth. We also see that during those years Spain looks much worse than once we add the post-crisis period with lower productivity growth and much higher increase in ULC. Comparing the two charts we can see that there has been a significant adjustment in Spain after the crisis both when it comes to GDP per hour and ULC relative to Germany.

So can low wages be the solution for some of the Euro problems? If the goal is to improve living standards, the focus must be on improving GDP per hour, that is the only way to ensure sustained progress. Having said that, for a given increase in GDP per hour, wage growth has to be consistent with these improvements in productivity so that unit labor costs do not grow too fast, otherwise a country will be pricing itself out of the market (and we will see that in a decline in the number of hours, unemployment)

Finally, the connection between wages and prices is also not as straightforward as some would argue. The numbers for labor compensation above are all in nominal terms, which is the right way to compare labor costs across countries and its relationship to competitiveness in global markets (more so when we compare two Euro countries so we do not need to worry about exchange rates). But the evolution of nominal wages can be very different from the evolution of real wages. Below I reproduce the first chart (excluding the UK) where I adjust wages and ULC for domestic inflation (using CPI).

If we compare Germany to Italy or Spain now we see that real wages did not grow significantly faster in Italy or Spain than in Germany, and this is of their higher inflation. When compared with GDP per hour we could still argue that real wage is high in the case of Italy but it looks as low in Spain as it does in Germany. Notice that when real wages grow slower than GDP per hour it must be that we are seeing a decline in the labor share, so an increase in the capital share. In other words, prices are not only related to labor compensation but also to profits.

In summary, no doubt that wage growth can in occassions be excessive and generate increases in labor costs with negative consequences on labor market outcomes. But insisting on moderation in wage growth regardless of the circumstances as a recipe for growth is not right. First, sustained growth in living standards can only be the result of increases in productivity (otherwise, why don't we just make wages equal to zero to maximize our competitiveness?). Second, what matters for competitiveness is prices and those depend not only on labor costs but also on the pricing power and decisions of firms. Excessive wage growth might be a drag on competitiveness but so can an excessive increase in profits or other forms of rents.

Antonio Fatás

Below is a chart that summarizes data provided by the OECD on productivity, compensation and unit labor costs. I computed the accumulated change from 2000 to 2013 (except for the US where there was no data for 2013, so the period is 2000-2012).

The blue column (real GDP per hour) represents improvements in productivity. This is the ultimate source of sustainable improvements in living standards. What we see is a significant gap between the US and Europe (more so if we consider that the US is 'missing' one year). When we look inside Europe we see a big outlier: Italy, where GDP per hour has barely changed in the last 13 years. There are some interesting differences among the other countries with Spain seeing an 18% increase over the period compared to 15% in Germany and 12-13% in France and the UK. In this first column, there is no obvious German miracle during this 13 years.

The second number is labor compensation per hour. This is measured in nominal terms (i.e. current Euros or US dollars or UK pounds) as it should be when talking about competitiveness. One expects that increased productivity gets reflected in increased compensation (in real terms) and in addition we should see the effect of inflation. Here Germany stands out as the country with the lowest wage increase (per hour). To make sense out of this number we should compare it to the increase in productivity as measured by GDP per hour. This is what the third column, the unit labor cost (ULC) does, it is simply equal to the change in labor compensation per hour minus the change in output per hour.

When looking at ULC we see that Germany has seen the lowest increase in labor costs per unit of output but not because of the highest increase in productivity but because of wage moderation relative to productivity gains. Italy and the UK are the countries with the largest increase in ULC through a combination of zero (Italy) or average (UK) productivity gains combined with significant wage growth. This is the German "miracle", the ability to convince workers to get paid less (relative to productivity) than in other countries. This is good news for German firms.

To make the "German miracle" look even stronger we can replicate the same analysis for the pre-crisis period (2000-2007).

So can low wages be the solution for some of the Euro problems? If the goal is to improve living standards, the focus must be on improving GDP per hour, that is the only way to ensure sustained progress. Having said that, for a given increase in GDP per hour, wage growth has to be consistent with these improvements in productivity so that unit labor costs do not grow too fast, otherwise a country will be pricing itself out of the market (and we will see that in a decline in the number of hours, unemployment)

Finally, the connection between wages and prices is also not as straightforward as some would argue. The numbers for labor compensation above are all in nominal terms, which is the right way to compare labor costs across countries and its relationship to competitiveness in global markets (more so when we compare two Euro countries so we do not need to worry about exchange rates). But the evolution of nominal wages can be very different from the evolution of real wages. Below I reproduce the first chart (excluding the UK) where I adjust wages and ULC for domestic inflation (using CPI).

If we compare Germany to Italy or Spain now we see that real wages did not grow significantly faster in Italy or Spain than in Germany, and this is of their higher inflation. When compared with GDP per hour we could still argue that real wage is high in the case of Italy but it looks as low in Spain as it does in Germany. Notice that when real wages grow slower than GDP per hour it must be that we are seeing a decline in the labor share, so an increase in the capital share. In other words, prices are not only related to labor compensation but also to profits.

In summary, no doubt that wage growth can in occassions be excessive and generate increases in labor costs with negative consequences on labor market outcomes. But insisting on moderation in wage growth regardless of the circumstances as a recipe for growth is not right. First, sustained growth in living standards can only be the result of increases in productivity (otherwise, why don't we just make wages equal to zero to maximize our competitiveness?). Second, what matters for competitiveness is prices and those depend not only on labor costs but also on the pricing power and decisions of firms. Excessive wage growth might be a drag on competitiveness but so can an excessive increase in profits or other forms of rents.

Antonio Fatás

Subscribe to:

Posts (Atom)